The recent rise in prices that beef producers are receiving for their cattle has led to an overall rise in positive outlooks for farmers regarding the ag economy, according to the latest survey from Purdue University’s Center for Commercial Agriculture.

Farmers’ appraisals of current conditions highlight a “tale of two economies”: Livestock producers remain highly optimistic about their farm conditions, partly supported by record-high profitability in the beef sector, while crop producers report a more pessimistic view of the current situation on their farms due to low profit margins across major crop enterprises. The barometer survey took place Oct. 13-17.

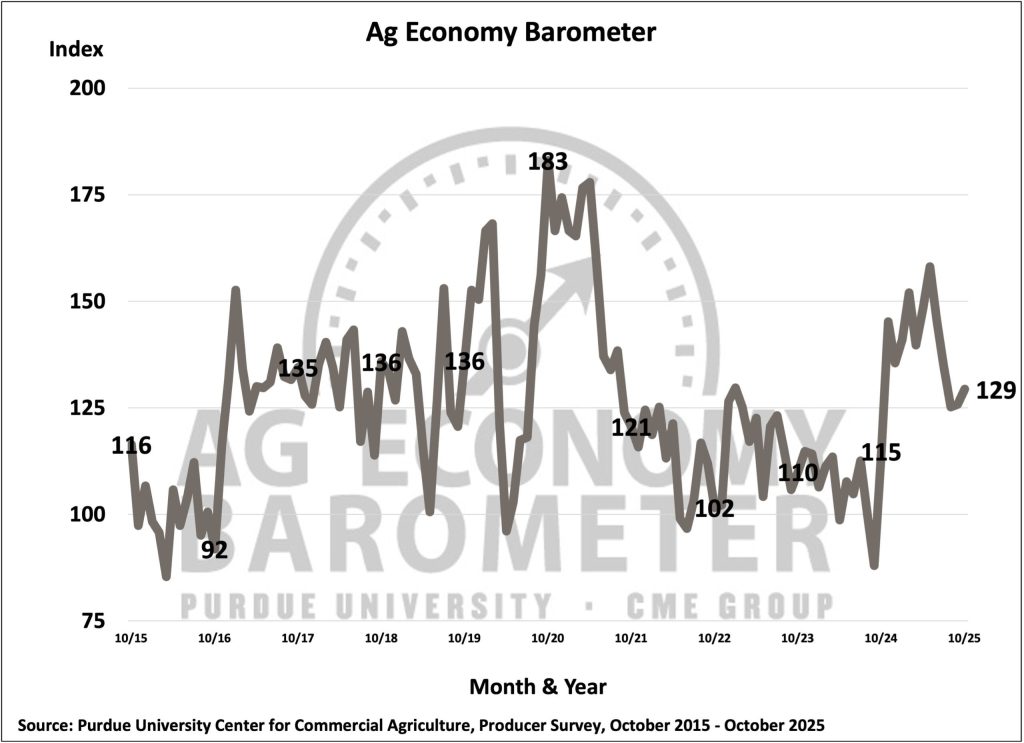

U.S. farmer sentiment edged slightly higher in October, with the Purdue University/CME Group Ag Economy Barometer rising 3 points to a reading of 129. The increase was fueled primarily by a rise in the Index of Current Conditions, which climbed 8 points to 130, while the Index of Future Expectations was virtually unchanged at 129, just 1 point higher than in September.

The Farm Financial Performance Index dropped to 78 in October, 10 points lower than in September, reflecting a sharp decline in farmers’ financial performance expectations over the past few months. In May, the index stood at 109, 31 points above the October reading, before steadily falling through the spring and summer. Similar to the Index of Current Conditions, there continues to be a disparity between crop and livestock producers: Crop farmers expect their financial performance to fall well below that of a year ago, while livestock producers anticipate results similar to the previous year. Despite the overall decline in financial expectations, the Farm Capital Investment Index increased by 9 points to 62, boosted once again by optimism among livestock producers.

In previous barometer surveys, most producers said they expect the U.S. Department of Agriculture to provide compensation for weak commodity prices, similar to the 2019 Market Facilitation Program. This month, respondents were asked how they would use a potential supplementary payment from the USDA on their farms. More than half (53%) said they would use it to pay down debt, while one-fourth (25%) said they would strengthen their farm’s working capital. Fewer producers said they would invest in farm machinery (12%) or cover family living expenses (11%).

The Short-Term Farmland Value Expectations Index rose 7 points in October to 113, following four months of declines. The shift in sentiment reflects more producers anticipating farmland values to increase rather than hold steady, reversing September’s trend. This month, 30% of respondents said they expect farmland values to rise over the next year, up from 24% in September. The percentage expecting values to fall remained essentially unchanged at 17%, compared to 18% the previous month.

“U.S. farmers are adjusting to ongoing economic pressures in different ways,” said Michael Langemeier, the barometer’s principal investigator and director of Purdue’s Center for Commercial Agriculture. “Livestock producers are seeing strong returns and remain optimistic, while many crop producers are contemplating management changes for 2026 to help cope with tighter margins.”

To learn more about how crop producers will respond to weak operating margins, the October survey asked respondents who planted corn in 2025 about any crop production management changes they plan to make in 2026 in response to low corn prices. Nearly one-third (30%) said they do not plan to make any changes, while 29% said they plan to reduce phosphorus applications. Twenty-seven percent said they intend to adopt lower-cost seed traits or varieties, 16% plan to reduce nitrogen applications, while just 11% said they would lower corn seeding rates in 2026.

Policy uncertainty continues to influence farmer sentiment. In October, 58% of producers said they expect increased use of tariffs by the U.S. to strengthen the agricultural economy, up from September but still below the 70% reported in April and May. Meanwhile, 16% of respondents said they were uncertain about the impact of tariff policies on the agricultural economy, double that of both April and May. Despite this uncertainty, roughly 70% of producers said they believe the U.S. is headed in the “right direction.”

Source: Purdue University’s Center for Commercial Agriculture