In the first set of government estimates since the shutdown began on Oct. 1, USDA’s much-anticipated World Agricultural Supply and Demand Estimate (WASDE) Report had a bearish impact across the board in the grain markets, sending corn and soybean futures down double digits by the close of trade on Friday afternoon.

The report offered mixed outlooks for major U.S. crops, trimming projected corn and soybean yields while leaving wheat production unchanged.

USDA lowered the national corn yield to 186 bushels per acre, slightly reducing 2025-26 production to 16.75 billion bushels. Exports were raised to 3.08 billion bushels, lifting ending stocks to 2.15 billion. The average farm price rose to $4 a bushel.

Soybean yield was cut to 53 bushels per acre, pulling production down to 4.25 billion bushels. USDA reduced export estimates to 1.64 billion bushels and projected ending stocks at 290 million. The farmgate price increased to $10.50 per bushel.

Wheat production held steady at 1.99 billion bushels, but USDA raised ending stocks to 901 million. The average price slipped to $5 a bushel. Globally, USDA boosted wheat and corn beginning stocks while trimming soybean supplies, and raised production estimates for Argentina, Australia and Russia.

In addition to the data in USDA’s WASDE Report providing a heavier outlook than expected, the export flash sale release showed far lower volumes than anticipated as well. Corn saw the bulk of flash purchases—which are purchases greater than 100,000 metric tons in one day—with wheat and soybeans seeing limited business being done. Soybeans did have a couple different flash sales for China, which confirmed the rumors of purchases. However, with less than one million metric tons combined sold to China and unknown destinations over the shutdown, the overall volume was much lower than expected. Only 332,000 metric tons of soybeans were sold to China throughout the course of the shutdown.

“That’s got the market jittery, and I think that was enough also to take some profits,” said Brian Basting, Commodity Research Analyst and Economist with Advance Trading, responding to the relative lack of Chinese soybean purchases since the trade agreement was made between the U.S. and China, which ended the Chinese boycott of U.S. soybean sales.

CLICK BELOW to hear analysis of USDA’s WASDE Report from Brian Basting with Advance Trading:

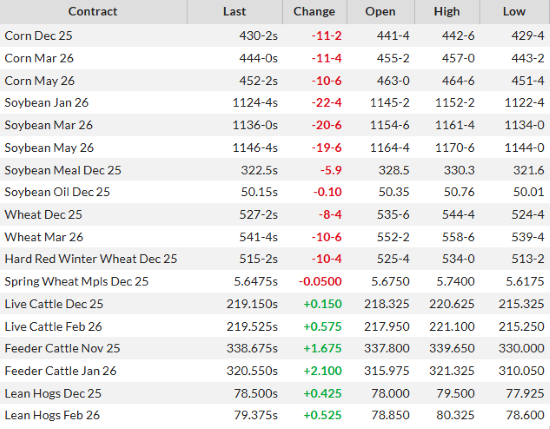

Below are settlements from the grain and livestock markets following the close of trade on Friday, Nov. 14, 2025:

Sources: USDA, Advance Trading, NAFB News Service