A lack of fresh news—either positive or negative—is causing the grain markets to trade in a “sideways” pattern over the past several weeks. But, that may likely change once harvest really gets into full gear.

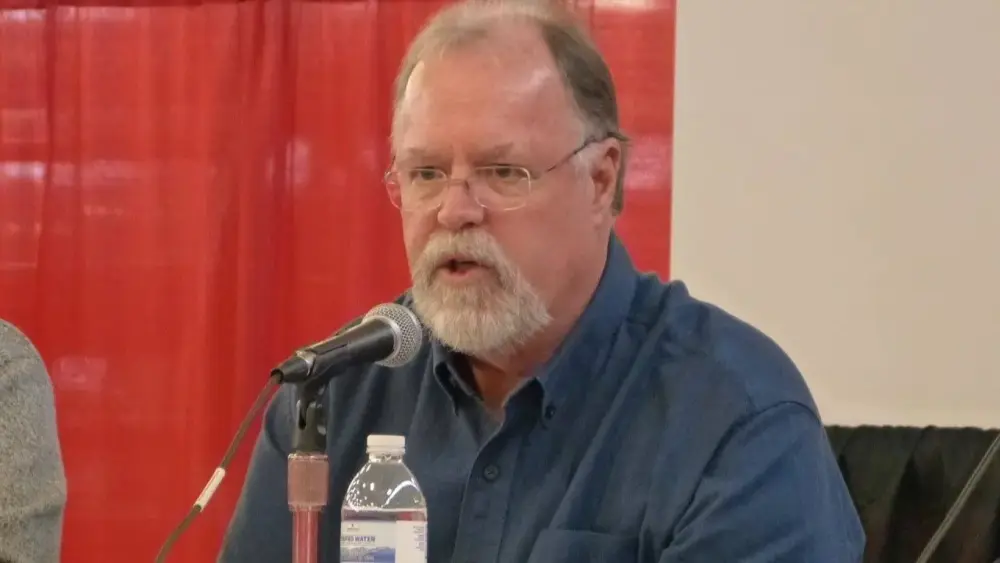

“I don’t want to say we’re beating a dead horse, but everybody is questioning the national yield. But are you going to do that everyday?” says Tom Fritz with EFG Group in Chicago.

USDA first said we’d see record yields for corn and soybeans back with the release of their Crop Projection report on August 12th. They made little change to those yield projections when that same report was updated and released on Sept. 12th.

USDA is forecasting a record-high average corn yield of 186.7 bushels per acre for 2025, as of the September 12th report. This yield is 7.4 bushels higher than last year and is part of a projected 16.8 billion bushels of total corn production for 2025. Meanwhile, USDA projects a soybean yield of 53.5 bushels per acre for 2025, which was a slight decrease from the previous month’s estimate, but would still be a record high if realized. This projected yield is part of a larger forecast for 4.3 billion bushels of total production for 2025.

“Nobody believes the national yields will be as high as the USDA says, but like I said, you can’t use that as an excuse every single day,” he says.

Fritz adds that lack of any fresh news over the past several weeks has been causing the grain markets to spin its wheels.

“I think it’s old news that U.S. corn is competitive to Brazil—in fact, it’s cheaper than Brazil given the break in the U.S. dollar and the rally in the Brazilian currency. Argentina? Well, they’re holding on to their money because of fear of economic reasons over there. So, bottom line, long story short, the U.S. continues to be the place to buy corn,” according to Fritz.

Brian Basting with Advance Trading says it may take several weeks—as well as a significant chunk of this year’s harvest to be completed—to truly gauge whether USDA’s projections for record corn and soybean yields are on target or off base.

“I think by the second week of October, we will know a lot in terms of both corn and beans, if the weather permits,” says Basting. “It may not be a concrete feel, I don’t want to give that impression, but definitely a better feel than now in this third week in September.”

One piece of news that has helped to push corn prices higher over the past forty days has been the rise in ethanol demand. As of the close of trade on Friday, Sept. 19, the December corn contract was $4.20 a bushel, which is $0.29 a bushel higher since Aug. 12 ($3.94 ½ a bushel) due to the recent spike in demand for E15. Grain market analysts believe that December corn could otherwise be well below $4.00 a bushel, if not for that increase in ethanol demand.

CLICK BELOW for Hoosier Ag Today’s radio news report.